Auto Sector In State Of Flux

At least three carmakers – Honda, Toyota and Mitsubishi – are expected to increase prices any time now, with some looking to do so as early as Oct 1. Other brands such as Hyundai are said to have already raised the prices of their models, including for the Santa Fe and Elantra.

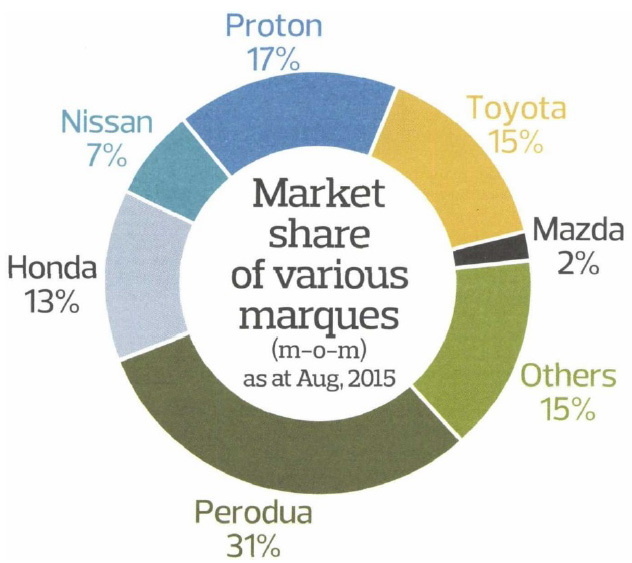

Second national car manufacturer, Perusahaan Otomobil Kedua Sdn Bhd (Perodua) — the market leader with a 31% market share — said earlier this month that it might increase prices as a buffer against the rising exchange rate.

The price hikes come at a time when the automotive industry is grappling with a weakening ringgit, dampened economic conditions and the implementation of the Goods and Services Tax (GST) in April — all of which adversely affected sales.

Malaysian Automotive Association (MAA) president Datuk Aishah Ahmad, for one, says price hikes are not necessarily the way to go. “Increasing prices is not going to help boost sales. On the contrary, it will worsen the situation as consumers are already tightening their belts due to inflationary pressures. However, there is a limit as to how much of the costs car companies can afford to absorb due to forex losses. It (increasing prices) is not an easy decision to make, and each company will have to evaluate its own situation,” she tells The Edge.

MAA was established in 1960 with the objective of developing and protecting the interests of its members, basically the automotive players, and making representations to the government on issues affecting the industry. Aishah says, “Uncertainties about the Malaysian economy and the impact of other domestic issues, coupled with uncertainties in the world economy, have dampened business optimism. Consumers are getting very cautious about spending on bigticket items such as new motor vehicles, especially in the lower and midrange segments.”

The stronger US dollar

An industry executive says that local players fork out euros for European cars and US dollars for all other makes. It doesn’t help that the US dollar has strengthened considerably, resulting in the ringgit losing close to a quarter of its value against the greenback since the beginning of the year. The ringgit tested 4.40 to the US dollar last Friday — the lowest level since 1998.

Likewise, the ringgit has shed about 15% against the euro since the beginning of the year, trading at 4.88 last Friday.

In a nutshell, the cost of doing business has increased, impacting those who deal with fully imported completely builtup units as well as completely knocked down units with very low local content. With rising costs, bottom lines generally take a beating.

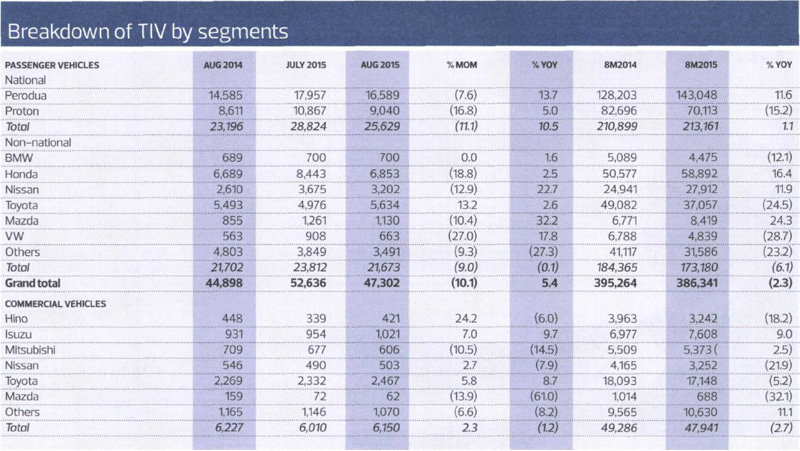

Making things worse have been the political and economic uncertainties. In August, after three consecutive months of gains, total industry volume (TIV) plunged 8.9% month on month to 53,452 units.

“The global economic fallout was the main contributing factor for the steep drop in sales. The implementation of GST, tightening of credit by the central bank and the poor performance of the ringgit — all have affected demand in domestic and export [markets] alike,” says SM Nasarudin SM Nasimuddin, joint group executive chairman of the Naza group, one of the country’s biggest automotive players.

He is noncommittal on when things will make make a turn for the better. “With the current market conditions, which may take a while to recover, buyers are more careful about their spending and prefer to hold on to their cash,” he adds.

It is noteworthy that Naza Automotive Manufacturing Sdn Bhd, which assembles Peugeot and Kia cars, was forced to lay off 255 workers late last month.

Another indication of the bleak situation was Sime Darby Motors Sdn Bhd scrapping its plans for an initial public offering (IPO) slated for this year, putting it off indefinitely, ostensibly due to the weak market sentiment. In August last year, Sime Darby was reported to have appointed Morgan Stanley, CIMB Investment Bank, Maybank Investment Bank and Deutsche Bank to manage the IPO, valued at slightly less than RM1.8 billion.

How bad is it?

While none of the local automotive players would provide the quantum of the drop in sales, one executive of a luxury brand says his company’s sales are down some 50%.Despite that, he adds, not all is doom and gloom.

“It’s about marketing your product. Mercedes and Honda seem to have done well despite the dip, and some Perodua models, Proton Iriz,are all right,” he says.

Datuk Tony Khor, president of the Federation of Motor and Credit Companies Association of Malaysia, concurs, saying the situation is not as gloomy as painted.The federation represents used car dealers.

“Malaysia is fundamentally strong. Lately, after the introduction of GST, there has been a slowdown in new car and used car sales … we were adversely impacted, but now, things seem to have picked up [again],” he says. He points to the better numbers from Mercedes and Honda, among others (see table), as one indication that it’s not all negative.

“The buying power and the strength are there. Our per capita income is more than US$10,000 per annum, but things are more competitive now,” Khor says. The car companies, he says, have under their belts 8 to 12 models at any time, compared with the 1990s when there were fewer companies, with each having only three to four models.

In a nutshell, it would seem the consumer is spoilt for choice.

Says Nasarudin, “The auto business is cyclical — you have good and bad times. Naza has been around for 40 years and had been through these cycles. Unfortunately, this year, our brands were impacted by a few factors such as unfavourable forex and an ageing model line.”

Nasarudin, 32, is the son of the late motor czar Tan Sri SM Nasimuddin SM Amin. To put things in perspective, in the 19 years Naza has been assembling and distributing Kia vehicles, it has sold more than 250,000 of the marque’s vehicles. And in more recent years, it has sold 40,000 Peugeot vehicles.

Former Proton Holdings Bhd CEO Tengku Tan Sri Mahaleel Tengku Ariff describes the scenario of the automotive sector as an overcrowding of players in a relatively small market, compared with the likes of Japan and South Korea.

“To many of these car players, Malaysia is a very profitable market. You can trace this from their market activities where huge discounts [are given] to drive sales or their companies’ financial results,” he says.

A check on the Companies Commission of Malaysia website shows that UMW Toyota Motor Sdn Bhd, the 51:49 joint venture by UMW Holdings Bhd and Toyota Motor Corp, registered an aftertax profit of RM962.3 million on revenue of RM10.7 billion for the year ended December 2014.

As at end-2014, the company had current assets of almost RM3.3 billion, noncurrent assets of RM982.5 million, shortterm borrowings of RM1.4 billion and longterm debts of RM30.5 million. UMW Toyota Motor had in excess of RM2.7 billion in reserves.

Honda Malaysia Sdn Bhd, which is 51% controlled by Japan’s Honda Motor Co Ltd, 34% by DRBHicom Bhd and 15% by Oriental Holdings Bhd, raked in RM135.7 million in aftertax profit from almost RM4.7 billion in revenue for its financial year ended March 2014. Honda Malaysia paid out RM81.2 million in dividends for the year in review.

Honda Malaysia had current assets of almost RM1.1 billion, noncurrent assets of RM721.8 million, shortterm debt commitments of RM898.6 million and longterm borrowings of RM108.4 million as at end March 2014. The company also had reserves of RM634.1 million.

Thus, it is no wonder that despite the dip in sales, several companies are said to be looking at expanding. Sources say Sime Darby Bhd is looking at opening more showrooms for its Range Rover and Jaguar marques in Johor Baru and Penang. Volvo, meanwhile, is said to be making preparations to have a bigger presence in Asean,with Malaysia as its hub.

Other big players such as Toyota have already invested in infrastructure in Asean, and are now looking at further strengthening their footholds in the region.

Local market leader Perodua registered an aftertax profit of RM509.9 million on revenue of RM8.7 billion for its financial year ended December 2014. As at endDecember last year, the company had reserves of almost RM3.2 billion. Perodua is 38% controlled by UMW Holdings, 20% by MBM Resources Bhd, 20% by Daihatsu Motor Co Ltd, 10% by PNB Equity Resource Corp Sdn Bhd, 5% by Daihatsu (M) Sdn Bhd, 4.2% by Mitsui & Co Ltd and 2.8% by Mitsui & Co (Asia Pacific) Pte Ltd.

Malaysia a mature market

Mahaleel puts it succinctly, “Primarily, the car industry is facing a demand issue, not a supply issue. They (automotive players) have made their sales projections based on an economic assumption of growth. So, the industry is chasing a number.

“Fundamentally,on a global basis since 2008, the world economy has slowed down with the US meltdown due to subprime problems.This, as we all know now, affected demand, including in Malaysia, and a drop in the prices of goods, especially commodities such as crude oil and palm oil, which Malaysia exports and earns from.

“Coupled with the various measures the government has implemented such as GST and utilities increasing their prices, invariably the endretail prices for essential goods rose. This has reduced substantially the average disposable income of consumers,” he explains.

Perhaps the writing is on the wall. In end July, MAA reduced its forecast TIV sales for the year to 670,000 units from 680,000 previously. At 670,000 units, sales this year would be 0.6% higher than 2014’sTIV of 665,675 units.

But is even this target achievable?

For the year to August, new car sales stood at 434,282 units, 2.3% less than in the first eight months of 2014, and only 62.8% of MAA’s forecast for this year.

TA Securities analyst Angeline Chin does not “see any rerating catalyst for the sector” and maintains her “underweight” call. Her estimate is that 657,000 vehicles will be sold in Malaysia this year, 1.9% less than MAA’s forecast. BIMB Securities, meanwhile, pegs TIV sales at 650,000 units.

Another point to note is that double digit growth numbers could be a thing of the past as the market matures.

Mahaleel notes that the ratio of cars to population in Malaysia, at 1:3, is equivalent to that of highly developed nations.

“Thus, to expect high growth rates at this stage of the cycle is not possible. In fact, if we don’t plan earlier, with new policies, the industry can and will face a decline,” he says.

A clear casualty of the decline in automotive sales is diversified DRB-Hicom, which is also involved in the property, defence and services sector, among others.

For its first quarter of FY2016 ended June, DRB-Hicom suffered a net loss of RM19.7 million from RM2.9 billion in revenue. In contrast to a year ago, it posted a net profit of RM107.8 million from RM3.7 billion in sales. For the current year’s first quarter, close to 76% of the company’s revenue, or RM2.2 billion, was from the automotive sector.

DRB-Hicom attributed its losses to “lower sales by the automotive companies following the initial impact Goods and Services Tax implementation”.

While DRB-Hicom’s main automotive outfit is national carmaker Proton Holdings, it also has a hand in the assembly and distribution of MercedesBenz, Suzuki, Honda, Audi, Mitsubishi and Isuzu, among others.

The Proton conundrum

National automaker Proton Holdings Bhd should be announcing its results for its financial year ended March 2015 within the next few days or by end-September.

There was a time when the national carmaker’s results would generate interest and dominate discussions among corporate players and analysts. Back then, circa 2002, Proton’s market share of the total industry volume was in excess of 60%.

In stark contrast, with the company no longer a publicly traded counter and struggling to make ends meet with a market share of less than 17%, the excitement is all but gone.

The last reported financials filed with the Companies Commission of Malaysia (CCM) indicate that Proton suffered an aftertax loss of RM821.4 million on the back of RM7.7 billion in revenue in FY2013. As at endMarch 2013, the company had noncurrent assets of RM3.8 billion, current assets of RM3.5 billion, current liabilities of RM3.5 billion and longterm debt commitments of RM33 million.

Proton had yet to announce its FY2014 financials at press time. Judging by the dampened economic climate — auto sales fell almost 9% in August — the current financial year is likely to be challenging as well for the carmaker. Nevertheless, firmly in Proton’s corner is Tun Dr Mahathir Mohamad, who launched the company during his tenure as prime minister. He believes Proton could be a success story with adequate government support.

“Yes, I admit Proton is struggling now [but it is] because of the lack of government support,” he said candidly in a recent interview with The Edge TV.

“Yes, I admit Proton is struggling now [but it is] because of the lack of government support,” he said candidly in a recent interview with The Edge TV.

He explained, “Because of the need to become very popular with consumers, the government opened the door to foreign imports, and these imports come from countries which closed their door to our exports. So, now, Proton has to compete against countries that are producing 10 million cars per year. How do you compete with them? The government is actually acting against Proton. Not giving any hope, support, at all.”

It seems it was difficult for Proton to venture into other countries such as South Korea, Japan or even China, as they had protectionist measures to safeguard their local industries.

“But there’s no more protection [for Proton]. Now, foreign cars are given exemptions. If they don’t comply with our needs, they are given exemptions.We have pointed out …there are 70 cars [that are being] given exemptions [but are] not complying with Malaysian requirements. But Proton does not get any exemptions,” said Mahathir.

To put things in perspective, Mahathir played a key role in the formation of Proton 32 years ago and put in place measures such as high taxes on imports to protect the national car. The government issued R&D grants amounting to hundreds of million ringgit to Proton. For instance, in the last financial results — for the ninemonth period ended December 2011 — announced before its privatisation, Proton said it had received a RM175 million R&D grant in 2010.

Nevertheless,without Mahathir at the helm, Proton has been ailing and sales numbers have been dwindling.

In August, Proton sold only 9,040 cars. For the first eight months of the year, it managed to sell 70,113 cars, which is less than half of rival Perusahaan Otomobil Nasional Kedua Sdn Bhd’s 143,048. Honda, the top selling nonnational car brand, sold 6,853 cars in August and 58,892 in the first eight months of the year.

Some Honda marques are assembled in Pagoh,Melaka, under a collaboration between Honda of Japan, Proton’s parent DRB-Hicom Bhd and Oriental Holdings Bhd.

Mahathir laments, “Everything is opened up. The government says we want a cheap car — and foreign cars assembled in Malaysia are cheap.

“Do you know what it means to reduce the sales of Proton? It means that people who started engineering companies to supply components to Proton, they’re suffering …About 200,000 people are suffering because of [the] government’s policy to encourage imports and discourage local industries,” he said in reference to the Proton Vendor Development Programme.

The programme has been accused of producing auto parts manufacturers that make substandard goods but which managed to thrive because of strong political connections. It is not known how the companies are faring or whether they have improved.

Nevertheless, Mahathir said, “Malaysians always expect a poorquality car [to be] selling cheaply. That is not Proton anymore. I’m excited about Proton. I think we can turn it around.”

The merits of scrapping

With traffic congestion in the country seemingly getting worse, and generally poor public transport systems, calls for a scrapping policy are getting louder, especially from the auto industry.

With traffic congestion in the country seemingly getting worse, and generally poor public transport systems, calls for a scrapping policy are getting louder, especially from the auto industry.

As at end-December 2013, Malaysia had a total of 23.7 million registered vehicles — 11 million motorcycles, 10.5 million cars and 2.2 million commercial vehicles — which is a lot for a population of about 30 million.

“We acknowledge that efforts have been made to improve public transport, like the MRT and LRT,” says Malaysian Automotive Association (MAA) president Datuk Aishah Ahmad. “However, the MRT and LRT lines are not extensive and would not be able to cover many areas. Moreover, these projects are mostly confined to the Klang Valley. Hence, people will continue to buy cars … it is no longer a luxury item but a necessity for most of us,” she says.

In March 2009, as part of a RM60 billion second economic stimulus package to help Malaysia through the global economic crisis, RM200 million was set aside as part of the Automotive Development Fund, which in turn, introduced the scrapping of vehicles that were more than 10 years old.

Under this plan, the government offered a RM5,000 discount to car owners willing to scrap their cars and acquire either a Proton or Perodua vehicle.This was intended to stimulate car sales and take some of the older cars off the roads to ease congestion.

According to the president of the Federation of Motor and Credit Companies Association of Malaysia (FMCCAM), Datuk Tony Khor, the scrapping scheme was a success.

National automaker Proton Holdings Bhd had in 2007 initiated a similar scheme, Proton XChange, where cars over 10 years old could be traded in for RM5,000 to get a new Proton car. This was later merged with the government’s scrapping initiative, which was however, discontinued in October 2010 after funds from the government dried up.

Proton received a total of 25,862 applications from March 10 to Oct 31 in 2009, fully utilising the funds from the government. At RM5,000 per car,40,000 cars could be scrapped with the RM200 million budget.

Most auto players, not surprisingly, support scrapping, including SM Nasarudin SM Nasimuddin, joint executive chairman of the Naza group. “Scrapping is indeed key in any developing or developed nation. It serves as a catalyst for new car sales. I’m not a pessimist but as long as global conditions don’t improve and forex is against us, it will be challenging,” he says of the current scenario.

So, the time could be right to introduce scrapping.

Auto sales in August fell by close to 9% to 53,452 units, while 434,282 vehicles were sold year to date — a drop of 10,268 automobiles, or 2.3% less than the corresponding period last year.

MAA has trimmed its total industry volume (TIV) forecast by 10,000 cars to 670,000. Some analysts are less confident, seeing a TIV of 650,000 units.

Khor of FMCCAM says he had proposed a voluntary vehicle scrapping policy for cars above 15 years old, with the government and manufacturer to offer RM5,000 as an incentive for a tradein for all CKD (completely knocked down) cars.To date, there has been no response, he says.

The MAA too had “proposed many times to the government to introduce a longterm autoscrapping scheme, for all makes and models”, says Aishah.

She says there should be a scheme for cars above a certain age to be scrapped, with guidelines set by the government under a vehicle scrapping policy. Before that can be done however, it is important to iron out all relevant issues, such as logistics and documentation, to ensure the scheme is acceptable to all stakeholders.

In a nutshell, scrapping provides the auto industry with an exit strategy, and is something that should have been done earlier — before the industry was maturing.

Former Proton Holdings CEO Tengku Tan Sri Mahaleel Tengku Ariff says, “If this is not done, there could be serious repercussions, one being too many cars chasing too few buyers. Therefore, I would strongly suggest a policy be developed to retire cars by an agreed criteria, as is done in many mature markets. This can take many forms and you can study how some countries have done it. We don’t have to reinvent the wheel.”

The auto sector is a multibillion ringgit industry, with thousands of jobs dependent on it. As such, it would make sense for the government to assist in boosting local demand for cars.

Aishah says there are 40 brands of passenger as well as commercial vehicles in the Malaysian market, an indication of the strong growth of the industry over the years. Increasing competition will drive car companies to offer greater choices,better products and services to attract consumers.

Government policies, especially taxes, affect the cost of a vehicle, especially excise duty,which ranges from 65% to 105%, she says.

“We hope the government can consider reducing the excise duty or Goods and Services Tax partially so as to help to boost demand for new motor vehicles,” she says.

Nasarudin says apart from scrapping, there are several other ways the government can assist the industry.

“The lending criteria could be relaxed a little, or perhaps pushing the energyefficient vehicle (EEV) agenda. The possibility of offering direct tax incentives to individuals and corporations that purchase diesel and other EEV vehicles could be considered … such as taxfree imports of diesel-powered vehicles. A similar measure was accorded to hybrid cars a few years ago,” he says.

Khor suggests that the government urge financial institutions to be more flexible on loan approvals. “Used car loan applications have a 50% rejection rate, and new cars, 47%. If the banks can be a little more flexible, it will help us,”

For Public Relations and Media related enquiries, kindly contact +603-2617 7888, ext. 458 or email us at nazapr@naza.com.my